calculated by comparing costs and benefits.

The results can be considered as the amount of taxes collected by the state into the budget, while expenses include funds necessary to collect these taxes. However, if the payer has paid a large amount of taxes, this can lead to a decrease in activity among entrepreneurs and investors, or to the transition of the business into the shadow that will further lead to a decrease in tax revenues to the budget [9].

In the authors’ opinion, the viewpoint of Yuri K. (an employee of the Federal Tax Service) is the most rational. According to this standpoint "the harmonization of tax systems can be assessed to some extent both in terms of tax collection and the level of the shadow economy in the country. After all, only a country, where the level of tax collection is high enough while the level of the shadow economy is not so great, can be considered civilized and prosperous." While agreeing with the author's basic provisions it should be noted, however, that evaluation factors should not be neglected. It is necessary to take into account the quality and expert assessment of legislation in the tax system, which contains many problems and legal conflicts.

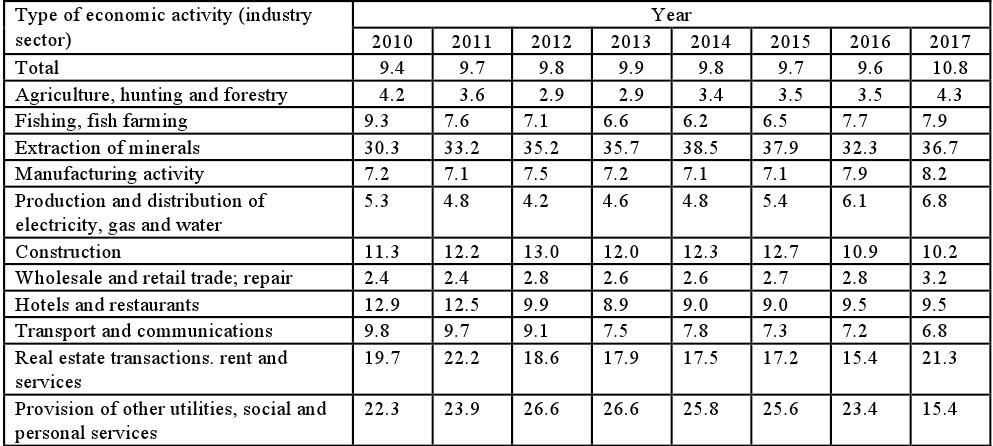

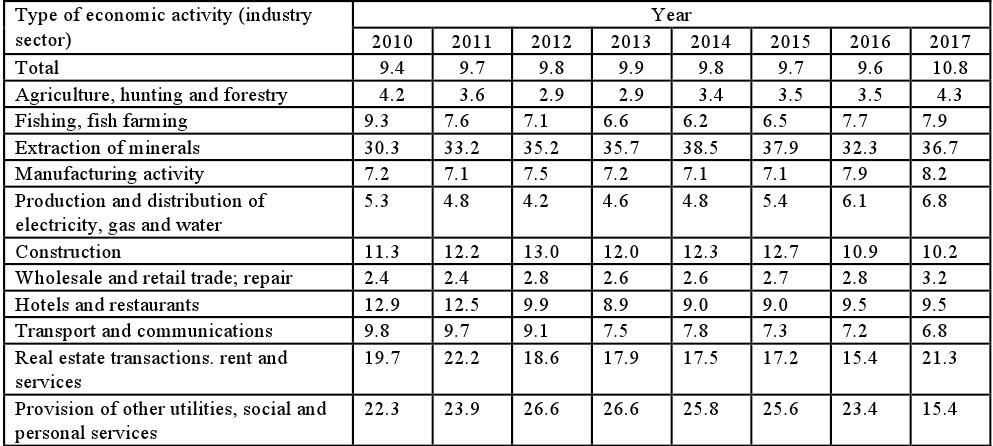

Taking into account these indicators, it becomes clear that one leading indicator of the tax security is the level of the tax burden on taxpayers, which shows how taxes and fees affect both individual business entities and the economic condition of the state (Table III).

Table III. Dynamics of tax burden indicators in Russia by types of economic activity (according to the method of the Federal Tax Service of Russia*), % * The calculation is made without taking into account income on consolidated social tax and insurance contributions for compulsory pension insurance

* The calculation is made without taking into account income on consolidated social tax and insurance contributions for compulsory pension insurance

The legal aspect of the tax security, according to experts, consists in the process of control over the tax system, creating conditions for fair taxation of social reproduction entities and declaration of conditions in the laws. In addition, regulatory provisions can be used to minimize abuses in the allocation of budget funds. The social aspect of the tax security, according to experts, consists in the degree of protection of the interests of all business entities, namely, the state, businesses and the population, through fair taxation, tax preferences, payment of taxes and the distribution of tax revenues among the agents of the financial system. The so-called tax culture and discipline should be formed, which will provide the necessary level of the tax security. One of the experts (Victor K., an employee of the city administration) notes that the social orientation of taxes should be manifested through the ratio of direct and indirect taxation. Moreover, direct taxation should prevail that will reduce the burden on consumers themselves, and in the case of effective tax rates will also activate the production process in the state. In addition, the expert continues, "the collected taxes should be effectively implemented to solve socio-economic problems to meet the interests of both the state and the population." Thus, in his opinion, only due to the sustainable development of the economy, society, and the rational use of budgetary funds, it is possible to achieve the necessary level of the TS, which will satisfy the interests of all subjects of taxation. However, all this is possible only with the functioning of an effective, efficient, and rational tax system. To determine the essence, methods, and construction principles of the economic nature of the tax security, the main risks and threats arising in the course of its efficient construction were determined during the survey. According to experts, the main source of the threat to the tax security is the tax risks, which should be understood as the probability of negative consequences for the tax system due to the inefficiency of its construction and functioning, the impact of existing threats, as well as external and internal factors. Thus, threats are a prerequisite for the occurrence of risks. The difference between them is that the risks are probable and can be measured quantitatively if they occur, while the threats are actually the existing dangers, which under the influence of factors encourage the occurrence of these risks, and their interdependence leads to financial losses for both business entities and the state, in particular, due to ineffective tax policy. To avoid the ambiguity of the concept of threat, the above-mentioned parameters should be defined both for the state (the entity that levies taxes) and taxpayers (the entities from which these taxes are levied). According to experts, the tax threats of the state include the following: a low level of tax culture, the existence of tax corruption, tax evasion, excessive expenses for the maintenance of the state tax bureaucracy, unjustified controversy in the current tax legislation, the growth of tax debt, and irrational use of taxes. The threats that taxpayers face include the following: uneven and unjustified distribution of the tax burden among business entities, a high proportion of economic entities that operate in the shadows, the outflow of national capital into the economy of foreign countries, and excessive interference of fiscal authorities in the economic activities of enterprises. Thus, the probability of negative phenomena for the tax security due to the inefficiency of the tax system, the action of existing threats, as well as the impact of external and internal factors should be considered as risks. That is, a prerequisite for the emergence of risks are threats. The main difference between these concepts is the following: the risk is likely to occur, and its occurrence can be measured, while the threat is already an established danger, which under the influence of certain factors leads to the occurrence of a certain risk. Their interdependence leads to losses for both the state and economic entities. The main risks and threats of the state tax security, identified according to the results of the expert survey, are presented in Table IV.

Table IV. Main risks and threats of the tax security of the state

Tax security is characterized by the ability of tax subjects to preserve the results of their activities under the influence of various external and internal threats and risks. The main goal of the state is to minimize tax risks by reducing the number of situations that pose threats to the tax security of taxpayers, society, and the economy in general. In turn, the business entities themselves should take into account the dangers and threats of their activities and will conduct economic activities as long as the results exceed costs. Otherwise, they will be forced to stop their activities, make certain changes to improve efficiency or move into the shadows that will have negative impact on the state, since business entities in their aggregate are the largest source of tax payments [10]. To ensure a sufficiently high level of social and economic life, it is necessary to take into account tax shortcomings, which are caused by inefficient and inadequate attitude of the state to taxpayers creating destabilizing factors in the tax system, namely, tax abuses and offenses, numerous tax evasions, and the use of intricate schemes of their collection [11]. All tax risks should be carefully studied and analyzed, while measures to eliminate them should be carried out, because in the case of a frivolous attitude to this issue, threats to financial security, in particular, and national security, in general, may arise. Taking into account the results of the conducted study and analyzing this problem for pragmatic reasons, tax risk management can be characterized as a process covering the following stages: — risk identification and assessment; — prioritization of risks; — work with risks, including the choice of methods to influence risks when comparing the effectiveness of the selected measures and decision-making; — assessment of work results with risks and management organization quality. Thus, the content of the tax risks management is defined as the process of identifying, assessing, and eliminating tax risks, preventing the possibility of their occurrence, improving methods of minimization, as well as neutralizing the possible consequences of their impacts. At that, tax risks may result in their possible negative impact on tax security or the problems created by these risks in the field of taxation. Ensuring the effectiveness of the tax risk management process requires its organization as a continuous cycle, which is based on an appropriate strategy taking into account the content and objectives of this process. The tax security risk management scheme, consisting of four successive stages, gives clear representation of this cycle performance: First stage: planning and definition; Second stage: risk analysis, assessment, and description; The third stage: risk neutralizing methods; Fourth stage: monitoring of means to prevent and counteract to risks. In this process, the main place is occupied by a combination of all the facts, circumstances and procedures relating to the organization of risk management to ensure the tax security of the state. A systematic approach to the essence of risk management and modeling of its functional and procedural characteristics has its advantages. Firstly, it allows effectively directing management actions (risk analysis, development of measures, etc.). Secondly, it helps to determine the logical interrelated sequence of actions to ensure the reliability of the relevant activities and the quality of the risk management organization in general. According to the proposed scheme, the quality monitoring of the risk management organization is carried out at different levels. At the first level, it is necessary to establish the effectiveness of a particular stage in the risk management process. At the second level, it is important to assess management by examining ways and means of achieving the objectives of the fiscal authorities. The third level concerns determining the quality of the risk management process organization in general to ensure the tax security of the state. Changes and development in the tax security system cannot be achieved without the perfection of information systems and analysis, improvement of scientific and technical potential, creation of information technologies, modernization of the taxpayer accounting system, application of new analysis and forecasting models by tax authorities, as well as without improvement of the payment accounting system [12]. Tax policy is the only one of the main tools for building an effective and efficient tax system, whose main task is to fill the budget with sufficient payments in the form of taxes, and their effective use. It is always difficult for the state to make the right decisions. Therefore, it is necessary to actively use the tax security indicators, which involves their calculations, subsequent analysis, and use of obtained data to build forecasts of the main indicators of the tax system. Correctly and timely calculated indicators will make it possible to have real figures on the economic development of the country [13], [14],

Table III. Dynamics of tax burden indicators in Russia by types of economic activity (according to the method of the Federal Tax Service of Russia*), %

* The calculation is made without taking into account income on consolidated social tax and insurance contributions for compulsory pension insurance

* The calculation is made without taking into account income on consolidated social tax and insurance contributions for compulsory pension insurance

The legal aspect of the tax security, according to experts, consists in the process of control over the tax system, creating conditions for fair taxation of social reproduction entities and declaration of conditions in the laws. In addition, regulatory provisions can be used to minimize abuses in the allocation of budget funds. The social aspect of the tax security, according to experts, consists in the degree of protection of the interests of all business entities, namely, the state, businesses and the population, through fair taxation, tax preferences, payment of taxes and the distribution of tax revenues among the agents of the financial system. The so-called tax culture and discipline should be formed, which will provide the necessary level of the tax security. One of the experts (Victor K., an employee of the city administration) notes that the social orientation of taxes should be manifested through the ratio of direct and indirect taxation. Moreover, direct taxation should prevail that will reduce the burden on consumers themselves, and in the case of effective tax rates will also activate the production process in the state. In addition, the expert continues, "the collected taxes should be effectively implemented to solve socio-economic problems to meet the interests of both the state and the population." Thus, in his opinion, only due to the sustainable development of the economy, society, and the rational use of budgetary funds, it is possible to achieve the necessary level of the TS, which will satisfy the interests of all subjects of taxation. However, all this is possible only with the functioning of an effective, efficient, and rational tax system. To determine the essence, methods, and construction principles of the economic nature of the tax security, the main risks and threats arising in the course of its efficient construction were determined during the survey. According to experts, the main source of the threat to the tax security is the tax risks, which should be understood as the probability of negative consequences for the tax system due to the inefficiency of its construction and functioning, the impact of existing threats, as well as external and internal factors. Thus, threats are a prerequisite for the occurrence of risks. The difference between them is that the risks are probable and can be measured quantitatively if they occur, while the threats are actually the existing dangers, which under the influence of factors encourage the occurrence of these risks, and their interdependence leads to financial losses for both business entities and the state, in particular, due to ineffective tax policy. To avoid the ambiguity of the concept of threat, the above-mentioned parameters should be defined both for the state (the entity that levies taxes) and taxpayers (the entities from which these taxes are levied). According to experts, the tax threats of the state include the following: a low level of tax culture, the existence of tax corruption, tax evasion, excessive expenses for the maintenance of the state tax bureaucracy, unjustified controversy in the current tax legislation, the growth of tax debt, and irrational use of taxes. The threats that taxpayers face include the following: uneven and unjustified distribution of the tax burden among business entities, a high proportion of economic entities that operate in the shadows, the outflow of national capital into the economy of foreign countries, and excessive interference of fiscal authorities in the economic activities of enterprises. Thus, the probability of negative phenomena for the tax security due to the inefficiency of the tax system, the action of existing threats, as well as the impact of external and internal factors should be considered as risks. That is, a prerequisite for the emergence of risks are threats. The main difference between these concepts is the following: the risk is likely to occur, and its occurrence can be measured, while the threat is already an established danger, which under the influence of certain factors leads to the occurrence of a certain risk. Their interdependence leads to losses for both the state and economic entities. The main risks and threats of the state tax security, identified according to the results of the expert survey, are presented in Table IV.

Table IV. Main risks and threats of the tax security of the state

Tax security is characterized by the ability of tax subjects to preserve the results of their activities under the influence of various external and internal threats and risks. The main goal of the state is to minimize tax risks by reducing the number of situations that pose threats to the tax security of taxpayers, society, and the economy in general. In turn, the business entities themselves should take into account the dangers and threats of their activities and will conduct economic activities as long as the results exceed costs. Otherwise, they will be forced to stop their activities, make certain changes to improve efficiency or move into the shadows that will have negative impact on the state, since business entities in their aggregate are the largest source of tax payments [10]. To ensure a sufficiently high level of social and economic life, it is necessary to take into account tax shortcomings, which are caused by inefficient and inadequate attitude of the state to taxpayers creating destabilizing factors in the tax system, namely, tax abuses and offenses, numerous tax evasions, and the use of intricate schemes of their collection [11]. All tax risks should be carefully studied and analyzed, while measures to eliminate them should be carried out, because in the case of a frivolous attitude to this issue, threats to financial security, in particular, and national security, in general, may arise. Taking into account the results of the conducted study and analyzing this problem for pragmatic reasons, tax risk management can be characterized as a process covering the following stages: — risk identification and assessment; — prioritization of risks; — work with risks, including the choice of methods to influence risks when comparing the effectiveness of the selected measures and decision-making; — assessment of work results with risks and management organization quality. Thus, the content of the tax risks management is defined as the process of identifying, assessing, and eliminating tax risks, preventing the possibility of their occurrence, improving methods of minimization, as well as neutralizing the possible consequences of their impacts. At that, tax risks may result in their possible negative impact on tax security or the problems created by these risks in the field of taxation. Ensuring the effectiveness of the tax risk management process requires its organization as a continuous cycle, which is based on an appropriate strategy taking into account the content and objectives of this process. The tax security risk management scheme, consisting of four successive stages, gives clear representation of this cycle performance: First stage: planning and definition; Second stage: risk analysis, assessment, and description; The third stage: risk neutralizing methods; Fourth stage: monitoring of means to prevent and counteract to risks. In this process, the main place is occupied by a combination of all the facts, circumstances and procedures relating to the organization of risk management to ensure the tax security of the state. A systematic approach to the essence of risk management and modeling of its functional and procedural characteristics has its advantages. Firstly, it allows effectively directing management actions (risk analysis, development of measures, etc.). Secondly, it helps to determine the logical interrelated sequence of actions to ensure the reliability of the relevant activities and the quality of the risk management organization in general. According to the proposed scheme, the quality monitoring of the risk management organization is carried out at different levels. At the first level, it is necessary to establish the effectiveness of a particular stage in the risk management process. At the second level, it is important to assess management by examining ways and means of achieving the objectives of the fiscal authorities. The third level concerns determining the quality of the risk management process organization in general to ensure the tax security of the state. Changes and development in the tax security system cannot be achieved without the perfection of information systems and analysis, improvement of scientific and technical potential, creation of information technologies, modernization of the taxpayer accounting system, application of new analysis and forecasting models by tax authorities, as well as without improvement of the payment accounting system [12]. Tax policy is the only one of the main tools for building an effective and efficient tax system, whose main task is to fill the budget with sufficient payments in the form of taxes, and their effective use. It is always difficult for the state to make the right decisions. Therefore, it is necessary to actively use the tax security indicators, which involves their calculations, subsequent analysis, and use of obtained data to build forecasts of the main indicators of the tax system. Correctly and timely calculated indicators will make it possible to have real figures on the economic development of the country [13], [14],